The Business Case of the U.S. Government

This is an unsustainable enterprise, but we can fix that if citizens hire the right elected officials to Congress

Table of Contents

Introduction: We have a problem

Two Case Facts: We’re overspending and over-leveraged

Conclusion: We need more innovative solutions for a sustainable future

Invitation: Join me tonight, February 22nd at 5:30 pm PT to talk about all this and more with Katie Porter - one of the smartest Congresspeople on this topic who is also running for U.S. Senate → RSVP AND DETAILS HERE

Introduction

If we look at the United States as a business, it feels like an unsustainable enterprise.

Why do I think this?

I had a vague sense of this before I ran for Senate when I found the seemingly annual specter of a government shutdown due to politicians’ inability to pass a budget to be frustrating. The arguments I read seemed overly simplistic - Republicans wanting to cut spending and Democrats wanting to raise revenues through tax hikes. The resulting impact always seemed to be: borrow more. Hence, all the headlines about mounting U.S. debt.

The equivalent in a business setting would be like an executive team telling employers and customers “sorry, we cannot serve you or pay you because we just can’t agree on a budget; we’re going to pay ourselves while we work this out, but y’all are screwed.” But in business, there would not be the option the government takes to borrow more money. At some point, lenders want their money back. And if you can’t pay it back, you go out of business.

When I ran for office, I dug into this more because I realized that budget ownership is shared between Congress (the House and the Senate) and the Executive Branch (the President and the Department Heads, ex: Department of Defense, Education, Agriculture, etc.). I learned more about the budget process and the core drivers or revenue and expense. My previously vague sense that this did not make a whole lot of sense solidified into a core belief of my campaign: we cannot keep going like this and we need to figure out a better way forward.

I learned that Departments (which would be like functions in a business) submit a budget to the President which the President then edits and passes to Congress. Congress approves it through 12 (!) subcommittees, which hold hearings. The House and Senate create their own budget resolutions, which must be negotiated and merged. Both houses must pass a single version of each funding bill. Congress sends the approved funding bills to the president to sign or veto (sources: HERE, HERE).

Wow!

I cannot imagine running a business - either in the private or nonprofit sector - this way. In business, you have a strategy and you finance a plan with resources put towards the essential few priorities required to make your strategy a reality. You measure the effectiveness of your strategy with numeric goals and there is accountability when you miss or meet those goals. You learn very quickly that you cannot borrow money indefinitely; at some point, you need to earn more than you spend or else you go out of business.

Of course our government is a public service, not a business. However, it still needs a plan to raise money, deliver services cost effectively and well with that money, and have a path to pay back any money it borrows.

I have low confidence in that plan for the U.S..

I think we need more people in the House and Senate who can better manage a budget against key priorities with their colleagues, regardless of party.

Below are the facts of the case as I know them along with my opinion on those facts. I’ve written this as simply as possible to empower more people to understand the business case of our government and vote for Representatives and Senators that can answer this simple question: “What is the plan for the U.S, to grow more sustainably and cost effectively while delivering outstanding citizen experiences?”

Fact 1: The U.S Government Spends More than It Earns

The United States raises money through taxes and spends on programming in line with what the Constitution’s preamble states the purpose, or mission statement, of the federal government is:

“…to establish Justice, insure domestic Tranquility, provide for the common defense, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity.”

As a country, we have been consistently spending more than we earn and we’re projected to keep this up in 2024.

We expect to spend $6.5 trillion dollars: $3.7 (60%) of which is already committed (to social security, and major health programs like medicare/medicaid) and $1.7 of which is discretionary: defense spending (13%), interest on our debt (13%), and everything else (14%).

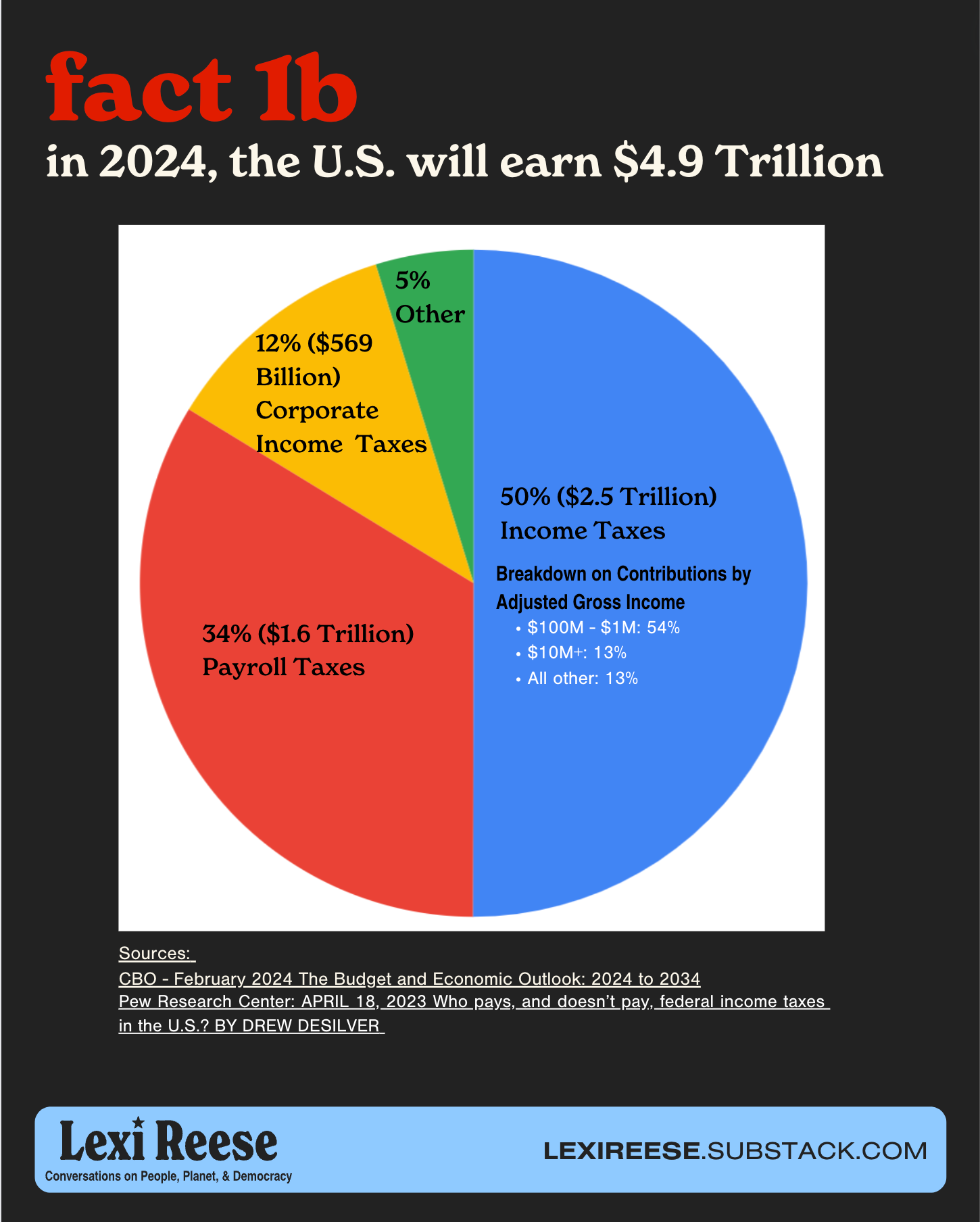

We’ll only earn $4.9 trillion, the bulk of which comes from individual income taxes ($2), payroll taxes ($1.6) and corporate taxes ($569 billion).

Fact 2: Both Parties Have Been Doing This for a Long Time; Now We Owe a LOT of Money

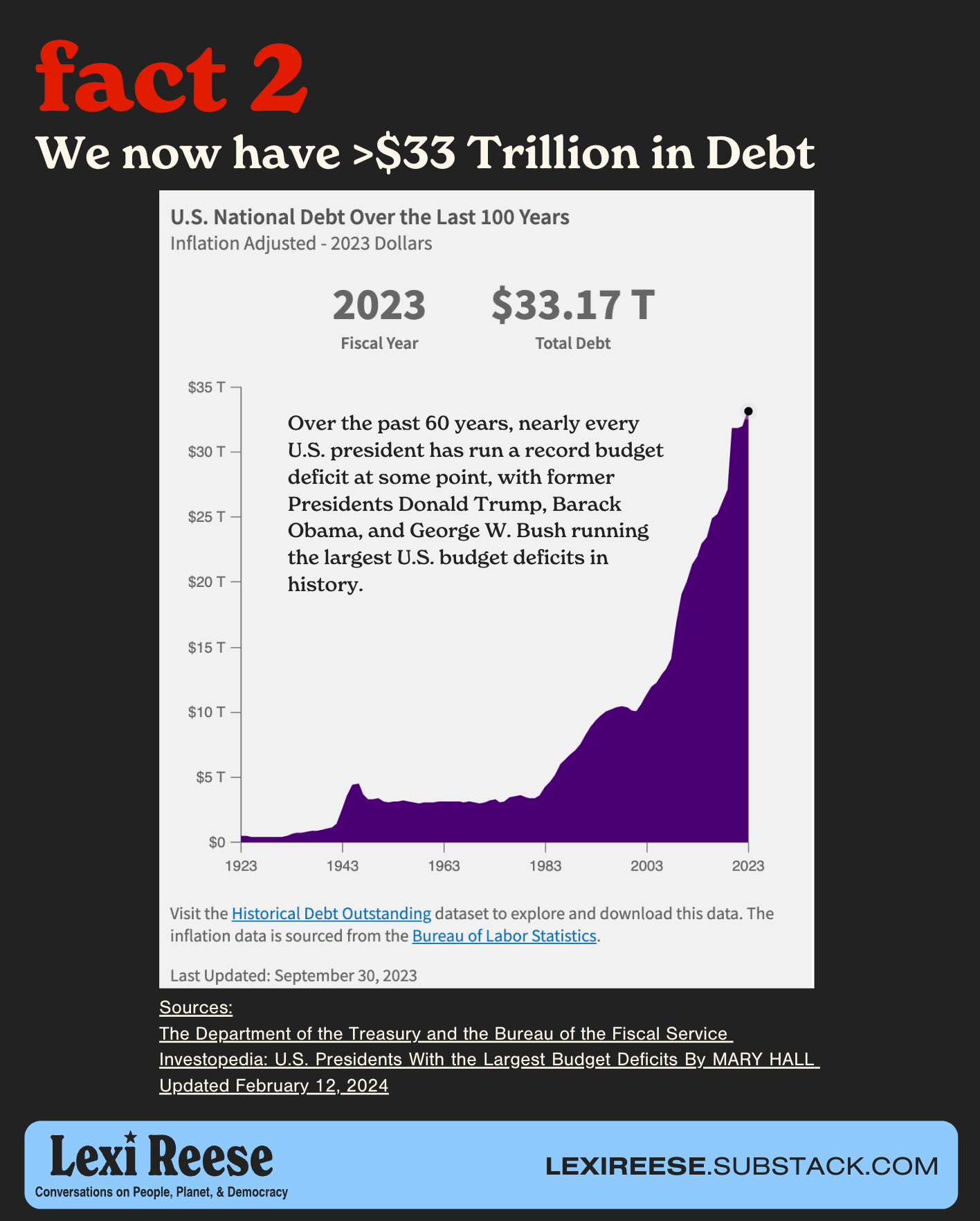

The national debt (~$34 trillion - a record even when accounting for inflation, according to recent data) is the total amount of outstanding borrowing by the Federal Government accumulated over the nation’s history.

Over the past 60 years, nearly every U.S. president has run a record budget deficit at some point, with former Presidents Donald Trump, Barack Obama, and George W. Bush running the largest U.S. budget deficits in history.

Simply put, the national debt is similar to a person using a credit card for purchases and not paying off the full balance each month. The cost of purchases exceeding the amount paid off represents a deficit, while accumulated deficits over time represents a person’s overall debt.

As individuals borrow from credit card companies, the federal government needs to borrow money to pay its bills when its ongoing spending activities and investments cannot be funded by federal revenues alone.

In total, 22% of our debt is intragovernmental, which simply records transactions between one part of the federal government and another.

The remaining 78% of the debt is held by the public — representing cash borrowed from domestic and foreign investors.

Of the approximately $26 Trillion debt held by the public, over 30% is owned by foreign entities (top holders are Japan and China), roughly 50% by private and public domestic entities (top holders are households and mutual funds), and over 20% by the Federal Reserve Bank.

Conclusion: We Need More Innovative Solutions for a Sustainable Future

Uncle Sam's massive debt isn't a secret, but the implications for our collective future are. We're swimming in a sea of red ink, owing more than we make (our U.S. Debt-to-GDP is 123% according to the International Monetary Fund); and the political lifeguards in Congress are busy bickering versus giving us a coordinated plan (another fight over the debt ceiling looms early next year; an agreement reached to raise it last May expires in January 2025).

The real worry lies beyond the headline number: are we spending our borrowed Trillions wisely?

Take Social Security, our fiscal behemoth. It rewards long careers and high pay, leaving parents who prioritize child-rearing financially stranded. In a nation where women's workforce participation lags behind men, this design leaves millions on the outside looking in. Is this what "promoting the general Welfare" looks like?

The answer is a resounding "no." We're not just spending Trillions, we're doing it without discipline. Our government, notorious for its molasses-slow pace and byzantine bureaucracy, is the antithesis of a lean, mean, value-generating machine.

So, what's the fix? A magic wand, alas, isn't included in the national budget. But here's what I would do if I had one:

Elect Budget Wizards: We need financial gurus experienced with managing budgets to outcomes in Congress. 70% of folks in Congress are lawyers and/or career politicians. We need to train these folks in agile budgeting or hire more people with that skill.

Think Lean: Embrace a start-up mindset where resources are limited but ambition is huge – automate, streamline, and squeeze every penny. The "time tax" on citizens is outrageous; let's fix it. Design the following experiences from a user perspective with a challenge to create “outstanding citizen experiences”:

Housing (Today, the experience is excruciating and tedious)

Employment (Today, losing a job means making a hundred phone calls to a state unemployment-insurance system)

Food (Today, applications are daunting and complex; California families are six times more likely to lose SNAP benefits the month they have to reconfirm eligibility)

Healthcare (Today, getting injured, sick, or having a disability requires you to become a hospital-billing expert)

Invest Smart: Don't just cut, invest strategically. Research, development, and talent are the seeds of future growth and security, not only defense. We are only spending 3% on research and development and most of that spend goes to four agencies, barely anything is being spent on how science and technology could help improve life for the bottom 50% of the country in education, agriculture, housing, etc. That is another signal that we’re not investing as wisely as we could and should.

Innovate: Our tax code is a labyrinth. Maybe it's time for a central, automated system that collects and distributes efficiently (see the Faroe Island example).

Communicate and Bring Others In: Keep citizens informed, engaged, and – dare we dream? – trusting. We ask for people’s money, but how can we better tap into their talents to help us on some of the bigger challenges we face.

This isn't just about numbers on a spreadsheet; it's about the American Dream. Can we afford it with our current trajectory? The answer, my friends, is blowing in the wind. But with the right choices, we can chart a course towards a future where opportunity, not debt, defines our national narrative. Let's demand better from our leaders, and ourselves, before the bill comes due.

I tend to think of our nation more as a society than a business. Obviously a lot of the trickle down economics of the last 30 years didn’t work great but we still have to live here in America. Making investments in infrastructure and education pay off in the long run. Being considered the land of opportunity for immigrants also brings us the best and brightest when we have functioning immigration policies.